The doomsayers who predict the collapse of the bourgeoning Chinese economy have been saying that China's dependence on exports will be their downfall as the world economy continues its downward spiral. But this view of China's dependence on foreign markets is both, narrow and short-sighted for a number of reasons.

Workers' increasing wages, standard of living and employment

With their population of 1.3 billion and increasing wages and standard of living for Chinese workers their economy is gradually shifting to a domestic, rather than global market. Salaries in China are expected to rise as much as 20 per cent, compared to the average 13 per cent increase seen in the last three years. And this uptrend is expected continue for the next 5 years.

"I think it is the most direct way to boost private consumption is to put money directly into the wallet of the labourer. If wage is going to rise over a number of years, I believe that the exchange rate will not appreciate as much, unless China's productivity really improves so rapidly that it is more than the wage increase, and more than the exchange rate increase. So I think the short term they can only choose one. If they choose that wage is going to increase 20 per cent per year, then probably the exchange rate will not appreciate as much."

- Chris Leung, senior VP and senior economist

of Group Research at DBS Bank

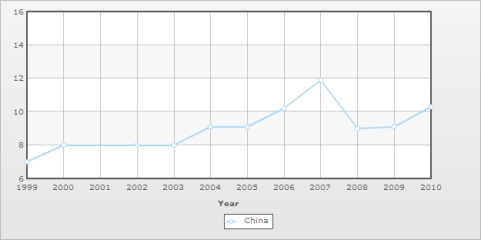

China's unemployment rate has dropped dramatically since 2009 with creation of new jobs and increased wage and benefit incentives.

(Source: Ministry of Labor and Social Security The People's Republic of China)

Economic Growth and Industrial Production

China's GDP expanded 2.20 percent in the second quarter of 2011 over the previous quarter, 9.5% over the same period a year earlier and their first quarter GDP rose sequentially 9.7% over first quarter, 2010. Their industrial production growth rose 15.1 percent in June compared with 13.3% in May, 2011.

|

|

|

China's annual real growth rate of GDP adjusted for inflation |

|

|

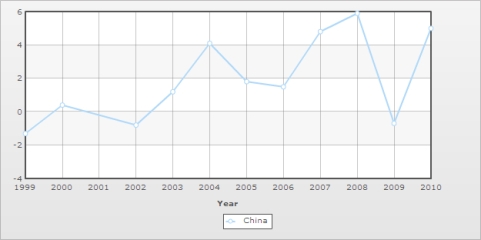

| The rate of inflation in China peaked in 2008, dropped dramatically in 2009 as a result of loss of export market in the 2008-2009 world recession and is now climbing again due to their stimulus package and recovery. Some western economists see the glass half-full. But inflation always accompanies rapid economic growth and viewed differently, the challenge of inflation for China is also an indicator of increased economic growth, personal incomes and domestic consumer buying power. |

|

|

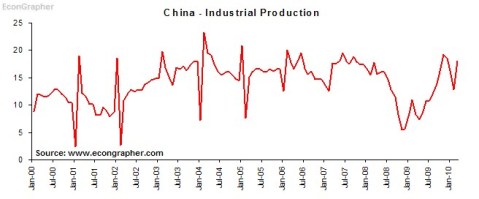

| Note that industrial production dropped in 2008 with the contraction of the global economy but then began to spike again in January 2009 due to China's enormous stimulus plan which we discuss below. For the last decade their industrial production has steadily increased. |

Domestic Private Consumption

The western media often gives an inaccurate picture that China's growth is due to foreign exports. Six years ago a quantified research report based on a survey of eight cities revealed that domestic private consumption contributed an average 46.5 per cent to the nation's GDP during the previous 5 years.* At that time, Yuwa Hedrick-Wong, MasterCard International's economic adviser for the Asia-Pacific Region, stated that "China's growth is driven by domestic consumption." The report predicted that private consumption of Chinese under 40 years of age would increase to 18 per cent annually from 2005 to 2015 and a 24-per-cent annual increase among those earning US$5,000 per year or more. Note that in the China Daily report (republished below), Chi Fulin, director of the China Institute for Reform and Development, calls for "the country's income distribution reform measures and a further adjustment of personal income taxation policy to increase the public's income." Domestic consumption in "developed countries" is still much higher (70%) but China's rate of increase in domestic consumption coupled with increasing wages, increased GDP and the potential for their huge population must be considered.

|

|

|

|

Source: Reserve Bank of Australia |

|

|

|

|

Source: Reserve Bank of Australia |

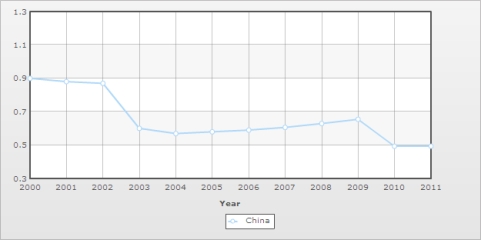

Diminishing Rate of Population

Another important factor is the growth of their population which was halved from 1999 to 2009 and was their slowest growth rate in a half century according to a 2010 census. Moreover, key to their future growth in population, they grew older during the previous decade, urban and more highly educated.

The rate of growth in China's population has steadily declined from the year 2000 to 2011. (source Index Mundi)

A difficult transition

Shifting from foreign to domestic markets will be delicate and timing in the context of a worldwide recession will be critical. Some Chinese manufacturers say that their factories may have to be closed, unable to keep up with rising wages. However, the DBS Bank claims that the services sector which is rapidly increasing will absorb the workers who lose jobs in manufacturing. Chi Fulin, cited in the article below says, "I hope people's consumption could be coordinated with the nation's production capability" ... and that, "we should make people wealthy before the country becomes rich."

China's Stimulus Package Goes to the People

China's stimulus plan to motor the economy in the face of worldwide economic recession is a whopping $586 billion amounting to a staggering 20% of their GDP. This has been allocated towards a vast infrastructure spending program that would cover 10 areas, much of it rural, including the construction of new railways, as well as projects aimed at environmental protection and technological innovation.

Investment in Infrastructure

About $54 billion (370 billion yuan), or 11%, of the $586 billion spending package has been allocated towards rural infrastructure projects to create jobs. China currently spends about 9% of its GDP on infrastructure, versus 5% in Europe and 2.4% in the United States. Over the next 10 years, China will spend $200 billion on infrastructure development alone, according to the CIBC.

DBS also thinks that China's new high-speed rail network "expected to send the economy steaming forward," will provide many opportunities for workers. Channel New Asia reports:

"In the long term, DBS said sectors that will benefit from the high-speed rail network include infrastructure and property. Property in the vicinity of the network can even command a 10 per cent premium."

|

|

|

|

Source: World Bank in Beijing |

|

|

|

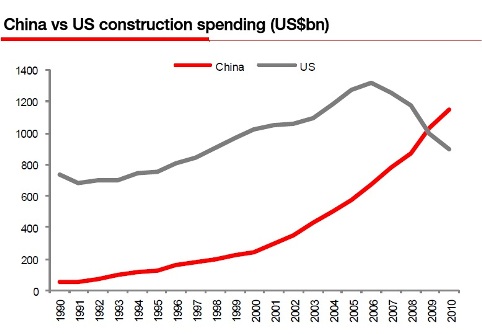

| China prepared for the world economic recession began in 2008 by investing heavily in infrastructure and has increased since then. |

|

|

| While China continues to invest more in construction within the country the U.S. invests less. |

Their road system alone is unprecedented with 12 major routes under construction across the country from north to south and east to west, The Wall Street Journal reported. The system will stretch 53,000 miles by 2020, topping that of the U.S. with 47,000 miles of roadways. On top of this, China is already planning to expand it's stimulus package to increase employment for workers who lose their jobs due to the planned attrition of their export market.

Conclusion

Call it socialism, capitalism or simple pragmatism - whatever you want. But this kind of imagination, creativity and commitment to the people and their infrastructure is sadly lacking in the west where national treasuries are being raided to pour tax dollars into the pockets of the vulgar rich and the wars of a failing global corporate empire.

*Note that in the article that follows, Chi Fulin said domestic consumption contributes around 37 percent to China's yearly GDP growth. Whether it's 37 percent or 45 percent as was reported by China.org it is the rate of increase in consumption, increase in workers' income, reduced unemployment and the building of the domestic market and infrastructure that mitigates.

- Les Blough, Editor

September 25, 2011 XIAMEN, Fujian - China should transfer its growth mode to a consumption-led economy under the new backdrop of world economy, experts said at a forum on Saturday. "China's reform and opening up implemented for more than three decades have proved a right decision and created a world miracle," said Zhou Wenzhang, vice president of the Chinese Academy of Governance. He was speaking at a forum focusing on China's reform and opening up and world economic growth in Xiamen, Fujian province. China has sustained a nearly double-digit year-on-year economic growth rate on average in the past 30 years, with its gross domestic product soaring from some $140 billion in 1978 to $6 trillion last year. China contributed more than 20 percent to the world's GDP growth during 2000 to 2009, slightly more than what the US contributed, according to Goldman Sachs. However, Chi Fulin, director of the China Institute for Reform and Development, said at the forum that China's growth has been largely driven by export and investment, rather than domestic consumption. Domestic consumption contributes around 37 percent to China's yearly GDP growth, while for developed countries, the figure is around 70 percent, experts say. Chi said the debt crisis in EU and the US means those markets will keep shrinking for at least five years, so it would be difficult for China to sustain its export-led growth. To achieve the transition, he said, a government-led growth mode should be turned into a market-led one, and "we should make people wealthy before the country becomes rich". Chi said China's economic growth rate in recent years is always quicker than people's consumption growth. "I hope people's consumption could be coordinated with the nation's production capability." To boost consumption, he suggested a quicker start for the country's income distribution reform measures and a further adjustment of personal income taxation policy to increase the public's income. The government should also adjust its role from being an investment pusher to a real public-serving facility, said Chi. Source: China Daily

China Daily

Domestic market key to growth

By Chen Xin