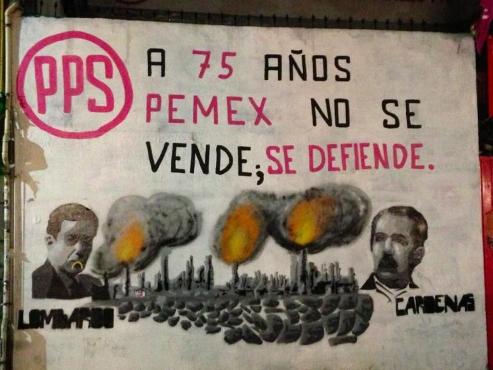

| Introduction The privatization of Mexico’s state petroleum and electrical enterprises has profound negative political consequences, both internally and in terms of its foreign policy. Most critical scholars and journalists have focused on the negative economic consequences of privatization and denationalization, drawing attention to the loss of revenues, profits, employment and control over national resources (“dependency”). In defense of public ownership, numerous experts, journalists and academics refute the charge of “inefficiency” by demonstrating that PEMEX ,the state owned petroleum company has lower costs of production per barrel than most private MNC and by pointing to the greater capacity to grow if the public enterprise was allowed to reinvest a greater percentage of their profits in new techniques and operations, instead of being raided to compensate for a regressive income tax system. While the economic arguments against privatization and denationalization of PEMEX and the electrical system are formidable, there is, in addition, powerful political, geo-political ad geo-economic reasons. The Mexican government’s decision to “privatize” the public oil and electrical industry means, effectively to ‘denationalize’ them, as the state is in negotiation with the foreign multi-national corporations lined up to submit their bids. Most of the major US oil multi-nationals are the most likely beneficiaries of the sell-off. As a result, major US oil corporations with powerful links to the US state will play a major role in shaping Mexico’s policy to its primary export sector in favor of Washington’s global strategic interests. Successful nationalizations It is important to remember, that multi-national corporations (MNC) are not only economic units but political actors. MNC have played a strategic political role in numerous contexts, always to the detriment of the “host country”. Numerous historical examples illustrate this fact. In 1961 when Cuba decided to import Soviet oil to counter US export restrictions, Texaco acting under orders from the White House refused to refine it and Havana was forced to nationalize the refineries. In recent times Venezuela increased the royalty payments of the oil companies to finance social programs. Several US MNCs refused to co-operate, in line with Washington’s plans to destabilize the Chavez government. They were nationalized. Similarly in Argentina, Repsol, the Spanish petrol MNC refused to fulfill its investment obligations in order to pressure the Kirchner government to modify it policies and was nationalized. The Spanish government intervened and set in motion an international judicial process. Multi-nationals penetrate internal politics During the early 1950s in Iran, British Petroleum and major US petroleum companies worked with the CIA in successfully overthrowing the elected Mosaddegh government to prevent nationalization and to secure lucrative concessions. Mexico’s history is replete with examples of US military and diplomatic interventions in Mexican politics in order to secure control and favorable concessions for oil companies prior to Lázaro Cárdena’s nationalization. Throughout history US policy toward Mexico was ‘made’ by the US mining and oil companies in Mexico.

Multi-national corporations combine economic interests with political leverage based on their links with political leaders inside of Mexico and the United States. Once an ‘economic opening’ is established, the MNC, can extend and deepen their penetration of the economy to related economic sectors and can use their political power to secure subsidies and tax exemptions at the expense of the Mexican treasury. MNC have a two way relation with the US imperial state: they exert pressure on Washington to intervene in any dispute with the Mexican state; and the imperial state can use the strategic position of the petroleum MNC to secure political co-operation from the Mexican state to oppose nationalists in OPEC, Venezuela and the Middle East. MNC became deeply involved in the internal politics of a country, aligning themselves with the most reactionary, anti-labor, anti-national classes. In Colombia, MNC use their economic resources to finance the electoral campaigns of right-wing politicians, parties and paramilitary groups. MNC are frequently involved in laundering illicit profits, paying bribes and corrupting politicians. In other words, the privatization and denationalization of strategic industries converts sovereign nations into semi-colonies, with reduced political influence in regional associations and the international system. Foreign owned MNC sharply reduce the political options of states in deciding marketing,and undermine invitations to become members of national and regional integration organizations like ALBA.. US petroleum corporations are integrated through a productive chain with their global subsidaries in an imperial economy. In contrast in Mexico they function as economic enclaves , limiting backward and forward linkages with other sectors, while subordinating satellite industries.

Conclusion The denationalization of strategic sectors of the Mexican economy increases national vulnerability to imperial pressures, isolates Mexico from regional alliances and creates a class of collaborator politicians whose primary loyalty is to the MNC – not to the citizens of the country. Within the current world disorder, Washington is continually engaged in wars in the Middle East, North Africa and South Asia.Ownership of the Mexican petroleum industry serves as a US strategic reserve in the face of boycotts and war-induced shortages. In any global conflict, Mexico, as a strategic supplier of petrol to Washington, will become an object or target of numerous US adversaries. The political costs to Mexico of denationalization of strategic economic sectors (like oil and electricity) in the context of growing political links to a highly militarized state, like the US, are high and have no commensurate benefits. Mexico effectively surrenders its political independence, isolates itself from its Latin American neighbors, fragments its national economy and deepens the colonial character of its state and economy. |