Report by Economic Debates Unit of the Latin American Strategic Center for Geopolitics (CELAG)

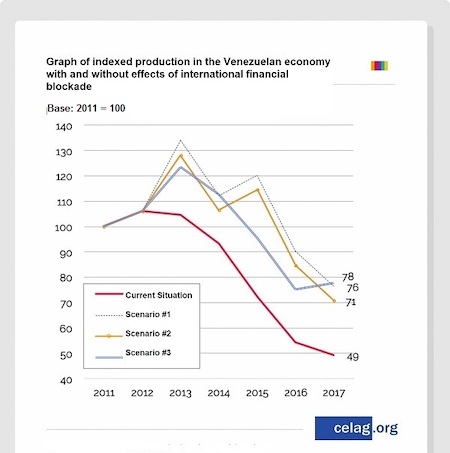

The Economic Debates Unit of the Latin American Strategic Center for Geopolitics s (CELAG) has conducted a study that shows that the international financial blockade against Venezuela from 2013 is primarily responsible for the economic crisis. This blockade meant the loss of $350 billion in production of goods and services between 2013 and 2017, according to one of the scenarios posed within the macroeconomic model that was used. (Note – the disastrous figures for 2018 are not even included in this analysis – AR) The study underscores the importance of financial blockades to strangle the economy of a country. External attacks on a nation's economic and productive ability can put an end to it in a matter of few years and, in recent times, tend to be the prelude to a military invasion.. In this sense, the authors warn that the alleged humanitarian crisis and the migration of hundreds of thousands of Venezuelans have their origin in the economic boycott implemented by the United States and its allies. However, the U.S. Government justify a possible military intervention due to the alleged humanitarian catastrophe and the mass emigration that its blockade was designed to create. In the case of Venezuela, the blockade has been based on the country’s expulsion from the international financial markets, preventing it from operating in credit market both to rollover expiring loans or to make new ones. In a country integrated into the world as a supplier of oil, production specialization led to a high dependence on imports that are financed with oil revenues. Therefore, the financial and commercial boycott of Venezuela has much more serious consequences than in diversified economies. Since Nicolás Maduro took office in 2013, the Venezuelan public sector had already stopped receiving net income flows of more than $95 billion - i.e., about $19 billion a year in the five-year period 2008-2012. To this the substantial increase in debt repayments must be added owing to the elevated Country Risk Premium imposed by Rating Agencies. While Venezuela punctually honored the repayments on external debt, Rating Agencies such as Standards & Poors or Moody´s placed the country risk above 2,000 points from 2015, with peaks of up to 5,000 and even 6,000 points more recently. The basis these rating agencies use in assessing countries are opaque but the tendency is to impose lower risk premiums on countries that favor free market policies and punish those who do not. This is how Venezuelan debt, despite being paid steadily and on time, was qualified as a high probability of default with a rating worse than countries at war such as Syria. (Note: 1000 country risk points =1% over ruling loan rate; therefore 6000 basis points = 6% a fortune when dealing in billions of dollars – AR) For this reason, the Venezuelan government had to pay more than $17 billion, about $3.300 billion per year in the five-year period 2013-2017. In short, if the annual average value of currencies that did not enter the economy due to the blockade ($19.2 billion) is added to what the country had to pay on average to service external debt ($3.3 billion) annually, it can be calculated that the economy and hence society suffered a choking loss of $22.5 billion annually as the result of a deliberate strategy of international financial isolation. Obviously this financial pressure escalated from 2015 with the drop in the price of crude oil.

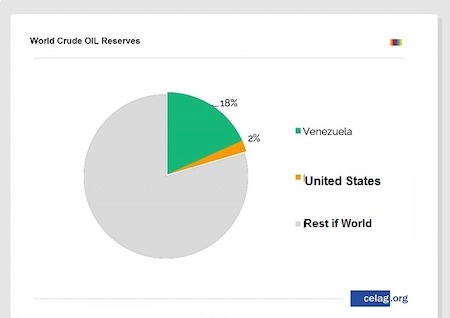

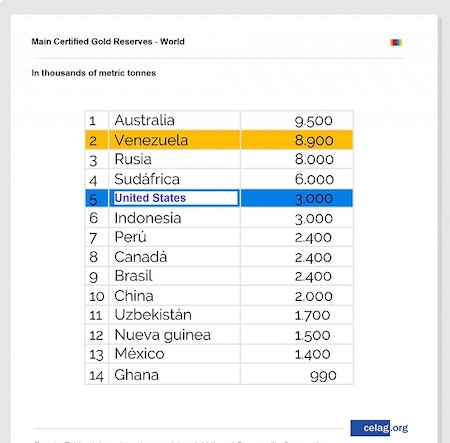

All the scenarios posed by the CELAG study show that the economy would have performed better in each of these years if it had had access to those “missing” $22 billion. On the other hand, the loss of that amount explains the 60% economic decline of the country’s GDP. As a result of the blockade, the losses in production of goods and services ranged between $350 billion and $260 billion in the period 2013-2017 - which means a per capita loss for each Venezuelan of between $12,200 and $13,400 per year. The country lost in that five-year period between 1.6% and 1.1% of its internal GDP. A country so dependent on imports as Venezuela cannot activate its productive apparatus without currency income. In metaphorical terms, the strangulation of foreign funding is tantamount to dropping bombs on the country´s factories and industries. If the government of Nicolás Maduro had enjoyed the international financing as that of Mauricio Macri in its first three years as president, Venezuelan GDP growth would be higher than Argentina's. Original URL Complete Report in Spanish **Translator’s Note: The “it’s all Maduro’s fault” brigade from the rabid right-wing as well as armchair lefties will now have to choke on their words after this authoritative analytical report from the CELAG. In the main report the motivation for the US destroying the Venezuelan economy and society is made crystal clear – it’s about oil, gold, coltan, diamonds, thorium, uranium and fresh water. It has nothing to do with establishing democracy in its own image or saving the Venezuelan people from an incompetent “dictator”. It’s just Genghis Khan type plunder using 21st century weapons - AR Original URL |