|

Looking back over the whole of this century the month of January has invariably begun with negative forecasts for the Venezuelan economy by capitalist “experts” known for their blind adherence to the financial model that almost brought down the world economy in 2008.

January 2015 has proven to be no exception to this regular event.

Basing its forecasts on the sharp fall in the international crude oil price from about US $95/barrel to around US $40/barrel at present, the IMF is forecasting doom and gloom for the Venezuelan economy in 2015. According to the neoliberal economist Alejendro Werner, who is responsible for IMF evaluations in Latin America, the Venezuelan economy is forecast to shrink by 7% in 2015 after shrinking by 4% in 2014.

The 4% figure is interesting as it is totally inaccurate. In his speech to the nation, President Maduro stated that the economy has shrunk by 2.8% in 2014. So from where Werner conjured up the 4% figure is a mystery. Perhaps from the hocus pocus of IMF methodology?

There are always coincidences, internationally speaking, when it comes to Venezuela-bashing both at home and abroad. For example, this month there are cries that President Maduro has to “change the economic model” to save Venezuela and turn around the situation that has been caused by hoarding, price speculation and an attack on the currency. The model that is espoused in the corporate media is of course, free market capitalism.

When Venezuela was run along such lines in the ‘happy 1990s’, inflation averaged around 52% per year for 8 years or so, peaking at over 103% in 1995. Wages were frozen for three years and the whole country was plunged into a recessionary vortex.

Do we really want such an economic model here again? Just look at the state Europe is in right now. The macro figures may look better than those of Venezuela overall BUT: unemployment has skyrocketed to a record 22 million; workers have had their wages reduced by 30% in Spain and Portugal; austerity in the best tradition of IMF medicine is being applied, making people’s lives miserable; pensions have been reduced or eliminated; and millions have had their homes foreclosed or are ‘under water’ with their mortgages. Moreover, even though there are now more jobs appearing in places, reduced wages make life untenable for workers and their families with no tangible rights or recourse.

Looking at Venezuela’s performance since 1999 The economic model launched by the late Comandante Chávez in 1999 is another matter, the results of which are deliberately ignored, both nationally and internationally, in the private and corporate media. Some selected achievements are:

Based on these revolutionary achievements – does Venezuela need to change its economic model and listen to the talking heads of the IMF and self-interested entrepreneurs? Draw your own conclusions.

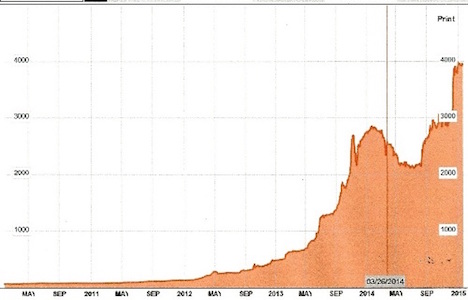

This century, the private banking sector has made more money than ever before and the Caracas Stock Market has risen from 8991 on December 31st 2002 to nearly 4,000,000 this month. Yes, that’s 4 million. In fact, due to the rise, the stock exchange authorities lopped off three zeroes from the index figure to make it more manageable. This measures the success of the private sector in Venezuela and is still the most dynamic stock market in the world due to the demand-driven economy here, which benefits the companies quoted in the index below.

The economic results have yielded a better quality of life for Venezuelans overall despite the 15 year campaign in the international media trying to discredit all the achievements of the Bolivarian Revolution.

Human Development Index (HDI) Here is a table of the components of the United Nation’s Human Development Index (HDI) from 1980 to 2012 for Venezuela, clearly illustrating the advances made for a population that is now reaching 30 million (at the end of the last century it was around 23 million according to the 1999 census).

Looking at the following table, do readers really think that the Venezuelan government should change to a free market capitalist model just to satisfy the unbridled greed of corporations and local businessmen longing for cheap dollars with which to feather their nests and bank accounts in the north?

Note that the HDI figure in the right hand column is based on a maximum of 1.00, which indicates the highest level of human development. The figure of 0.748 for 2012 places Venezuela in the high human development category. The highest HDI figure in the region is 0.758 for Panama, followed closely by Cuba.

Bolivarian Republic of Venezuela’s HDI trends based on consistent time series data, new component indicators and new methodology

GINI Index Another key

international index that illustrates the success of Venezuela’s socialist

economic model promoted by the Bolivarian revolution and its policies is the

GINI Index that measures the Distribution of Family Wealth in a country. The

CIA World Fact Book lists all countries’ (except Cuba) GINI Index performance.

The lower the figure, the more equal a society is. We can see examples of

societies with social justice in mind from the figures below as well as

neoliberal inequality taking more for the already well-off on other examples.

Based on these results, does Venezuela need to change its economic model from the socialist path to one of free market capitalism? I guess the answer is no, as the lot of most Venezuelans has improved significantly since 1999.

The improvement is because oil revenues have been sown for the first time in the interests of the population as a whole. Since 1999, 60.3% of all oil revenues have been invested in health, education, and social programs – whereas in the previous 40 years of capitalist policies only 37% were destined to the masses.

In addition, billions of bolivares (the national currency), are now collected from all types of tax revenues by the Venezuelan Inland Revenue Service (SENIAT). While these bolivares finance many projects and 69.7% of the Social Missions – funding for the cornerstone of the social revolution is generated from local tax collection, according to Ricardo Sanguino, president of the Financial Commission of the National Assembly.

Changing the Economic Model The economic model in Venezuela does need changing, but not in a retrograde sense back towards free market capitalism. This is despite induced inflation, contraband and shortages that must gradually be defeated by combined governmental and institutional actions, backed by organized people.

First, the private sector has to be brought to heel – especially distributors and wholesalers – and must be made to serve the interests of the country by applying the laws and the Constitution.

After the experience of the oil industry sabotage of December 2002–February 2003, when the private sector tried to starve the population and the revolution into submission, it was clear that the distribution system should be changed even then so as to safeguard food supplies from being diverted, smuggled, or hoarded.

Now, since mid 2013, the private distribution sector has made life difficult for all Venezuelans when trying to find basic goods. These companies must be obliged to act responsibly and not favor destabilization for political reasons. If they continue on their current path, confiscation of businesses and all assets, plus jail time for the perpetrators, is the only answer.

This is the first change in the economic model that must be implemented as soon as possible.

The second change must be the installation of a more endogenous productive model so as to substitute many imports of food and medicines. Food imports had been very high for years – around 65%, but declined to around 35% (not including wheat which does not grow in these climes) during the revolution.

Conclusion Despite economic problems caused by the economic war fostered by US covert action in Venezuela to create the illusion in the media that everything is a disaster, the facts prove that the economic model introduced by Chávez has worked, benefitting great swathes of the population. Even the capitalist private sector has benefitted thanks to higher wages and government investment in the population and the economy as a whole.

This progressive model must continue despite cries that it is unsustainable due to the fall of the oil price. Financing has been secured until at least the end of 2016 to ensure that the economy remains relatively stable and as Venezuela is a sovereign, independent state, the government can generate money in local currency – exactly what the US Federal Reserve does and as the European Central Bank is proposing to do with the €1.1 trillion it has grasped out of thin air to boost the European economy. Hence, Venezuela is using the same banking mechanisms as the developed countries so as to advance the wellbeing of its still growing young and dynamic population.

© Copyright 2015 by AxisofLogic.com

|