|

For almost two years, by combining various points of view

(speculative, geopolitical, technological, economic, strategic and

monetary…), we have continued to anticipate a major crisis in the entire

oil sector.

Today, no one doubts the fact that we are actually at that point, and

the GEAB [GlobalEurope Anticipation Bulletin] must therefore anticipate the consequences of this veritable

atomic bomb, which has begun to blow up all the old system’s pillars:

everything which we have known, international currencies, financial

markets, the US, the Western alliance, world governance, democracy, etc.

Global systemic crisis: the end of the West we have known since 1945

Here, we would like to look back on a historic GEAB anticipation,

that of Franck Biancheri in February 2006, which announced the beginning

of the global systemic crisis under the title “the end of the West we

have known since 1945” (1). It will have taken nine years for this

Western world to collapse (or seven years, if we begin the process with

the 2008 subprime crisis, as one should really do)… During these nine

years, the GEAB has worked to educate on the crisis, with the avowed aim

of raising all the existing solutions to exit it as quickly and as

painlessly as possible. Apparently, outside the work carried out by the

BRICS which, also anticipated by the GEAB, got through a huge task to

lay down the foundations of tomorrow’s world, the Western world,

meanwhile, has made some positive efforts here and there, signs of which

we detect in some places. But at the end of 2014, and after the huge

destabilization caused by the crash of Euro-Russian relations in the

Ukrainian crisis, our team is struggling to put forward a positive

scenario for the coming year.

2015 will show the complete collapse of the Western world we have

known since 1945. It will be a gigantic hurricane, which will blow and

rock the whole planet, but the breach points are to be found in the

“Western Port”, which hasn’t been a port for a long time but, as will be

clearly shown in 2015, has been in the eye of the storm in fact, as we

have repeatedly said since 2006. Whilst some boats will try to head

offshore, the Ukrainian crisis has had the effect of bringing some of

them back to port and firmly re-mooring them there. Unfortunately, it’s

the port itself which is rocking the boats and it’s those with the

strongest moorings which will break up first. Of course, we are thinking

of Europe first and foremost, but more so Israel, the financial markets

and world governance.

Of course peace is at stake, a peace which is no more than a vain

word, moreover. Ask China, India, Brazil, Iran, etc., if the West still

conveys any image of peace. As for democratic values, what we show

serves more as a foil than a model… to the extent that the universal

principle of democracy is relegated to the value of culturally

relativized concepts and finishes by serving antidemocratic agendas of

all ilks, in Europe and elsewhere. Yet it’s not the democratic principle

that is the problem (quite the opposite is needed to reinvent ways to

apply it, in partnership with the new emerging powers), but really the

West’s inability to have known how to adapt its implementation to

society’s new characteristics (the emergence of supranational political

entities, the Internet which is transforming the social structure..)

The oil crisis is systemic because it is linked to the end of the all-oil era

Let’s return for a moment to the principal characteristics of this

systemic oil crisis which we have analyzed. To quickly summarize and to

highlight the systemic nature of this crisis, to better position our

anticipations which follow, it’s the oil market’s world governance

system OPEC,

which has been undermined. The US, which was its master until around

2005 (2), has seen the arrival of the emerging nations whose levels of

consumption has inevitably made them joint masters.

Oil consumption: in red, by the US, Western Europe and Japan; in

blue, by the rest of the world. Source : Yardeni / Oil market

intelligence.

Of course, it would have been necessary to acknowledge

this change by a reform of the old system of governance to put

everybody in the same boat. Instead, frightened by the idea of a rise in

oil prices to which the US economy (totally dependent on oil, unlike

Europe, and lacking any significant and coordinated investment in

renewable energy) was unable to resist, the US decided to break any

rationale of global coordination by creating a competing market, the

shale market, intended to reduce prices. Unfortunately, we know what

competition in terms of access to energy resources leads to… at least

Europe is supposed to know (3).

|

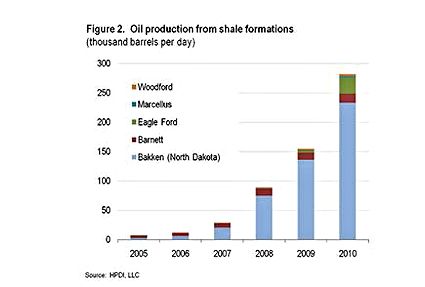

| US shale oil production – Source : HPDI, LLC |

Another strong

trend is combining with this major trend break, currently little

mentioned in the media, that of the end of oil as the world economy’s

primary energy source. And it is this second factor that now makes the

situation totally uncontrollable. Prices are falling apart because the

oil era is coming to an end and nobody can do anything about it. We

anticipated this many months ago (4) : China is creating an all electric

car fleet (5), and, in so doing, will turn the global car fleet into an

all-electric one: once the technology has been mastered and mass

production becomes inevitable, all the world will go electric. We

anticipated that this transformation would be in place in less than 10

years and that, in five years, the turning point as regards consumption

would be reached. But a year at least has passed since this

anticipation. Speculators of all stripes are starting to see a horizon

four years out (6).

In reality, « peak oil » is what LEAP calls a “successful

anticipation”: putting it into perspective, has allowed the problem to

be “avoided”. Fear of a shortage and a price explosion, good and bad

avoidance strategies (renewable and shale), all combined with a huge

economic downturn and, as a grand finale, and an ecological agenda whose

resumption we will see from this year (7), and the world is “ready” to

close the oil era… except that, to this, the players existentially

related to this commodity will make themselves heard loud and long

before disappearing.

Here again, so that our readers don’t misunderstand: for a long time

oil will continue to be used to fuel the world’s engines and factories

(it even has many years ahead of it again since the risk of shortage has

been postponed for several decades), but the “era” of sovereign oil is

ending and, of course, that constitutes a systemic change.

In the Telescope section we further examine the consequences of this

systemic oil crisis, particularly on the financial markets. These

financial markets, which have well “resisted” six long years of crisis,

suffocating the real economy in their vice and proving the extent to

which they were the crux of the problem, will not be able to survive the

shock that they are about to get, from the oil industry on the one hand

(a central player), and the dollar on the other (financial world’s main

tool). But, as if it weren’t enough, other bombs are ready to explode…

Notes

(1) Source : LEAP/Europe2020, 15 February 2006

(2) In

fact, the beginning of the rise in oil prices dates from 2003, and began

to explode in 2006. But 2005 is a recurring date as soon as we analyze

price increases in terms of the emerging nations’ consumption instead of

the vagaries of Middle Eastern geopolitics, and generally as soon as

one sees the emerging nations’ rise in power.

(3) The two

world wars at the beginning of the 20th century were intrinsically

linked to competition for access to energy resources (source: Cambridge Journals,

09/1968), which is why, at the end of the Second World War, the

European Communities gave birth to the pooling of resources, the ECSC

(source :Wikipedia ),

a project which should have remained one of the lightning conductors of

European construction, whilst today the Ukrainian crisis reveals the

gaping hole in Europe as regards a common energy policy. And to say that

some find that we suffer from too much Europe!! Actually, European

construction came to a halt in 1989… busy regulating the size of

cucumbers and freeing the rest: “the European cucumber”…

(4) In our recommendations last January (GEAB N°81) under the heading « China goes electric ». Source :LEAP/E2020, 15/01/2014

(5) Source : Bloomberg, 09/02/2014

(6) For

those who doubt the reality of this development there is the recent and

incredible decision by Germany (incredible because it’s completely

counter intuitive to the current decline in oil prices) to bet

everything on renewable energy and package everything which is

nuclear-gas-oil-coal to get rid of it Source :Deutsche Welle, 01/12/2014

(7) Last

month we noted the very tangible results achieved in promises to reduce

CO2 emissions, including from the US, under Chinese leadership. And

although the Lima Summit hasn’t seemed to produce much in the way of

results meanwhile, it’s particularly because the poor countries are

pretending to continue to believe that Western dollars are going to

finance their energy transition. But in substance, the environmental

agenda is very dynamic currently, essentially because it coincides with

the strategic objectives for the first time of the world’s first (or

second) power, China.

Source: Global Research

|